In the realm of business finance and bookkeeping, cheques continue to play a vital role in managing payments, expenses, and financial documentation. While digital transactions have surged in popularity, accounting cheques remain essential in many industries, especially for small to mid-sized businesses, government agencies, and organizations that require detailed, traceable payments.

This article delves into what accounting cheques are, how they function, their advantages, integration with accounting software, and how they support effective financial control.

What Are Accounting Cheques?

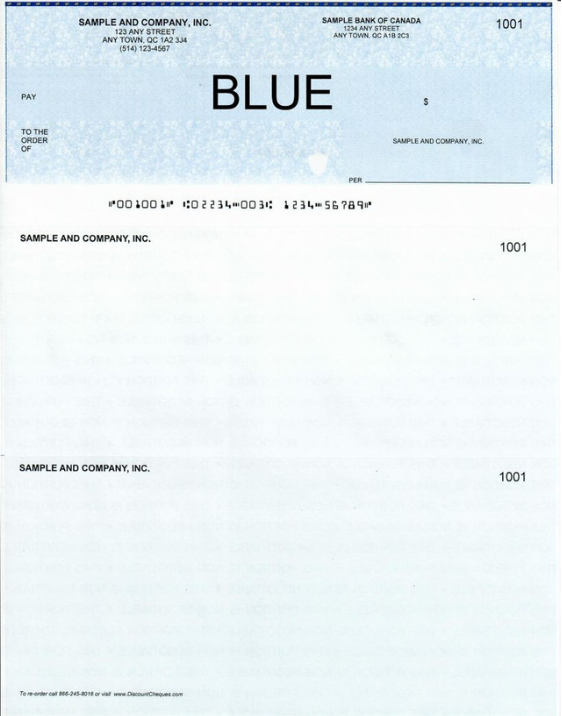

Accounting cheques are specialized business cheques designed for use in conjunction with accounting systems and software. These cheques are typically pre-formatted to include detailed payment information and often come with stubs or vouchers that provide a clear breakdown of the transaction.

Unlike personal cheques, accounting cheques are part of a broader financial workflow and serve both as a payment method and a recordkeeping tool. They help businesses track expenditures, manage payroll, issue vendor payments, and maintain an accurate audit trail.

Key Features of Accounting Cheques

- Voucher or Stub Format

Most accounting cheques come with one or two stubs (known as check vouchers) that stay attached to the cheque or are kept for records. These stubs include:- Payee name

- Date and cheque number

- Invoice numbers

- Description of the transaction

- Amount paid

- Pre-printed Information

Accounting cheques often contain pre-printed details such as the business name, address, bank information, and MICR (Magnetic Ink Character Recognition) codes. - Compatibility with Accounting Software

These cheques are formatted to align with popular accounting systems like QuickBooks, Sage, Xero, and FreshBooks. This ensures seamless printing and reduces manual entry errors. - Security Features

Many accounting cheques include anti-fraud features such as watermarks, microprinting, security screens, and chemical-sensitive paper to protect against tampering and forgery.

Types of Accounting Cheques

Accounting cheques come in various layouts to accommodate different business needs:

- Cheque on Top: The cheque is at the top of the page with two stubs below. Ideal for general payments.

- Cheque in Middle: The cheque is in the middle, often used for payroll.

- Cheque on Bottom: The cheque appears at the bottom with a stub above, useful for software systems that require bottom-aligned printing.

- Continuous Cheques: Used with dot matrix printers for high-volume environments.

Businesses choose formats based on software compatibility, printer type, and internal processes.

Benefits of Using Accounting Cheques

1. Streamlined Bookkeeping

Accounting cheques simplify the reconciliation of bank statements and financial records. Since each cheque is linked to an entry in the accounting system, it becomes easier to match payments with invoices and monitor cash flow.

2. Clear Audit Trail

Cheques offer a paper trail, making it easier for auditors, tax professionals, and business owners to trace financial transactions during audits or financial reviews.

3. Enhanced Accuracy

Pre-formatted cheques reduce the risk of manual errors, especially when used with accounting software that populates cheque data automatically.

4. Improved Financial Control

Each transaction made with an accounting cheque is documented, reducing the risk of unauthorized payments and allowing better oversight of spending.

5. Professional Appearance

Custom-branded accounting cheques add professionalism to a business’s financial operations, especially when dealing with vendors, contractors, or financial institutions.

Integration with Accounting Software

Modern accounting cheques are designed to integrate directly with widely used accounting platforms. This integration allows users to:

- Automatically populate payee and payment information

- Print cheques in bulk

- Maintain accurate records without double entry

- Reduce administrative time and increase efficiency

Many companies also use laser printer-compatible cheques, which can be printed directly from accounting software, saving time and improving legibility.

Considerations When Ordering Accounting Cheques

When purchasing accounting cheques, businesses should consider the following:

- Software Compatibility: Ensure the layout matches your accounting system’s specifications.

- Security Features: Opt for cheques with modern anti-fraud elements.

- Paper Quality: Use high-quality paper for durability and professionalism.

- Customization: Include company logos and contact details to reinforce branding.

- Supplier Reputation: Work with trusted cheque printing companies that comply with banking regulations.

Common Uses of Accounting Cheques

- Vendor payments

- Payroll processing

- Reimbursement of expenses

- Charitable donations

- Utility and tax payments

- Government or institutional disbursements

Despite digital advancements, many of these transactions are still conducted using accounting cheques, especially in traditional or regulated sectors.

Conclusion

Accounting cheques remain a fundamental component of effective business financial management. They combine the simplicity of paper payments with the precision of digital bookkeeping, offering a secure, organized, and traceable method for managing expenditures.

While electronic payments are on the rise, accounting cheques continue to serve specific needs in business environments where documentation, compliance, and control are crucial. By integrating seamlessly with accounting software and offering robust security and functionality, accounting cheques provide a dependable solution for businesses looking to maintain financial accuracy and professionalism.

Whether you’re a small business owner, accountant, or finance manager, incorporating accounting cheques into your payment system can streamline your workflow and strengthen your financial foundation.